Today, bond rating agencies are downgrading corporate credit at a faster pace than any point in the last decade. The coronavirus has sapped product and services demand and disrupted global supply chains. Investment grade corporate debt, particularly the BBB-rated category - only one-step above speculative-grade junk - is creating tremors for the U.S. corporate bond market. According to The Wall Street Journal, the BBB-rated bond market has grown to a staggering $3.4 trillion in debt outstanding. Credit downgrades applied to only a fraction of this outstanding debt could nearly double the size of the junk bond market by 2021 and institutional investors would be unable to absorb such a shock.

“Fallen angels,” in finance parlance, refer to corporate issuers that transition from investment grade into junk status. Public companies long considered to be inherently financially sturdy have suddenly become quite risky. In February 2020, the Kraft Heinz Company’s credit ratings were cut from “BBB” to the “BB” category, which added approximately $30 billion in debt to the junk bond market. As the coronavirus has impaired public company profitability, swaths of public companies are receiving FRISK® score downgrades.

Now more than ever, professionals need to be monitoring their portfolios for changes in risk trends. CreditRiskMonitor saves you time and effort by providing:

- Daily updated FRISK® scores, which predict public company bankruptcy with 96% accuracy

- Bond agency ratings and research reports from Fitch, Moody’s and DBRS Morningstar

- Financially relevant news alerts on companies in your portfolio

Latest Fallen Angels

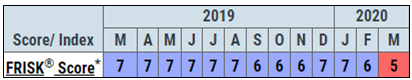

On Mar. 23, the Ford Motor Company became the largest fallen angel after its credit rating was cut by S&P, adding $155 billion in automotive debt and consumer credit to the junk market. Two days later, Moody’s downgraded Ford’s ratings related to softness in the automotive market prompted by the coronavirus to, “reflect what is an already-stressed credit profile and a very long-term restructuring program. The company is now additionally burdened by the prospect of a severe and prolonged decline in automotive markets precipitated by the coronavirus.” The company’s one-year credit default swap spreads increased from only 200bps to more than 850bps in just over a month, according to Factset. Ford’s FRISK® score has also been downgraded from neutral to the high-risk “red zone.” The FRISK® score is measured using a “1” (lowest risk) -to-“10” (highest risk) scale, with anything equal to “5” or less indicating financial stress. Ford’s FRISK® score decline reflects adverse factors including:

- Weak financial statement ratios, including trailing 12-month operating losses and high leverage

- Pessimistic stock market behavior with a 40% decline in year-over-year market capitalization and total liabilities exceeding market capitalization by 11x

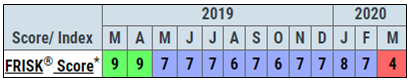

On Mar. 26, Macy’s Inc. had its credit rating downgraded from “BBB” to “BB.” Macy’s received a healthy credit review back in 2018 but was pushed off the cliff following lost in-store retail sales due to the coronavirus. Macy’s even disclosed in a Form 8K filing that it had fully drawn down on its credit revolver of $1.5 billion. Its one-year credit default swap spiked from less than 100bps to more than 1300bps month over month, according to Factset. The FRISK® score declined due to the credit downgrade and negative subscriber crowdsourcing activity. Subscriber crowdsourcing reflects the research activity being conducted on the CreditRiskMonitor service by senior risk officers from more than 35% of the Fortune 1000. Certain research patterns within the commercial credit report, such as in-depth financial analysis and review of corporate filings, among other actions, can be indicative of concern. Integrating this aggregated behavior into the model underpins the increased risk profile:

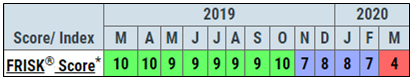

On Mar. 18, Occidental Petroleum Corporation also obtained fallen angel status, dumping nearly $40 billion into the junk debt market. Occidental’s acquisition of Anadarko Petroleum Corporation created the largest U.S. independent oil & gas company. In a cruel twist, the timing couldn’t have been worse with the ensuing breakdown in WTI crude oil prices from $55 per barrel to $20, in part triggered by the coronavirus. Occidental now carries higher consolidated financial leverage and will have difficulty selling noncore assets to address approximately $6.4 billion of maturities over the next year. Its one-year credit default swaps have risen from less than 100bps to well over 1,600bps in only six weeks, according to Factset, indicating a substantially greater risk of default on its unsecured notes. The FRISK® score deteriorated into the high-risk category following:

- Rising stock price volatility and adjusted market capitalization declining by 78% year-over-year

- The credit downgrade into junk

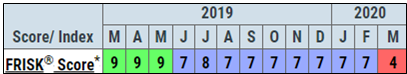

On Mar. 26, The Gap Inc. was downgraded from “BBB” to “BB” following declining consumer demand and widespread store closures. Due to the immense strain on operating cash flow, the company tapped a $500 million revolving credit facility to bolster its liquidity profile. However, the company also carries a large $1.25 billion bond set to mature in April 2021, which may carry refinancing risk. Moody’s explained in its research note that it maintains a negative outlook given: “Gap's need to reset its cost base in the face of the unprecedented disruption of COVID-19 and an expected slowdown in consumer spending. The negative outlook also reflects its need to manage its cash burn through its operational and financial policy actions while refinancing its capital structure.” The FRISK® score decline primarily pertains to:

- Trailing 12-month operating profitability declining by 58% year-over-year

- High stock price volatility and a year-over-year market capitalization return of negative 78%

- The credit downgrade into junk

With so many corporate issuers falling into the BB-rated segment of the bond market during March, credit conditions have tightened, and risk premiums have vastly increased. Credit spreads in the BB-rated segment have increased from only 2% to 6.5% and the broader high-yield credit market has skyrocketed to 9%.

Bottom Line

The four aforementioned fallen angels have debt maturities within the next two years and could see their interest costs swell post-refinancing. Now consider the damage transpiring for companies with even weaker credit quality. Professionals need to have a keen focus on FRISK® score declines, credit rating downgrades, and corporate balance sheets. With every downgrade, the size of the junk debt market continues to expand and an economic downturn will set the stage for record public company defaults and bankruptcies. Counterparty risk management has never been more important.