Part of CreditRiskMonitor's Mid-Year Review series, we focus on the volatile state of casual dining establishments and how the FRISK® score is helping credit and procurement managers stay ahead of bankruptcy risk.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

CreditRiskMonitor offers up five quick and important facts that you need to know about Bed Bath & Beyond Inc. to make a more solid business evaluation – or, more advisable, even an alteration of credit extension or a pivot to a peer.

The offshore oil and gas market remains widely depressed. Troubled outfit Hornbeck Offshore Services, Inc. has fallen to a FRISK® score of “1,” which indicates severe financial distress.

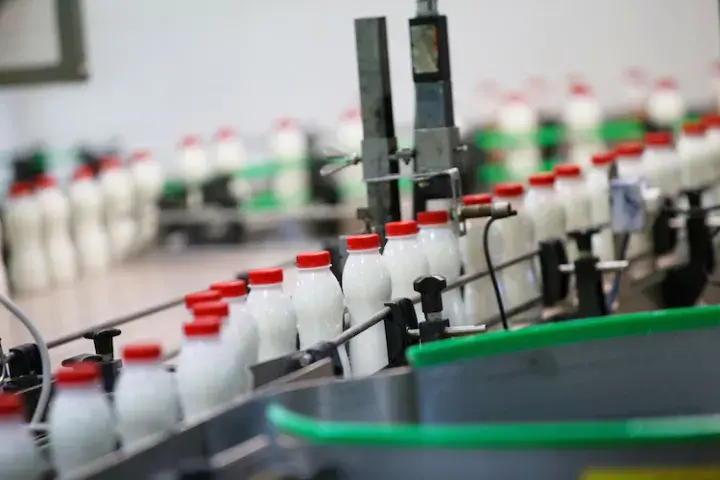

It’s rare to see a consumer staple food processing company falling into financial distress, but CreditRiskMonitor’s FRISK® score on the Dean Foods Company has been signaling elevated risk to our subscribers for more than a year.

Roadrunner Transportation Systems, Inc., a large U.S. domestic trucking company, has been highlighted as a financial risk by CreditRiskMonitor’s proprietary subscriber crowdsourcing.

As the likelihood of an economic downturn continues to intensify, public companies across cyclical industries like trucking should be monitored closely.

Knowledge of how and when to react to a business defaulting is essential; cutting ties with a customer or supplier too soon could lead to a missed sales opportunity, while being too late can result in financial loss.

Heavily indebted public companies - including perhaps theaters near you - are reeling as countries around the world shut their economies to slow the progress of COVID-19.

Public company bankruptcies soared in 2020, and filings continue to roll in as fallout from COVID-19. Here are five of the most notable Chapter 11 cases we've seen so far in 2021, and another five companies we feel are in big-time danger.