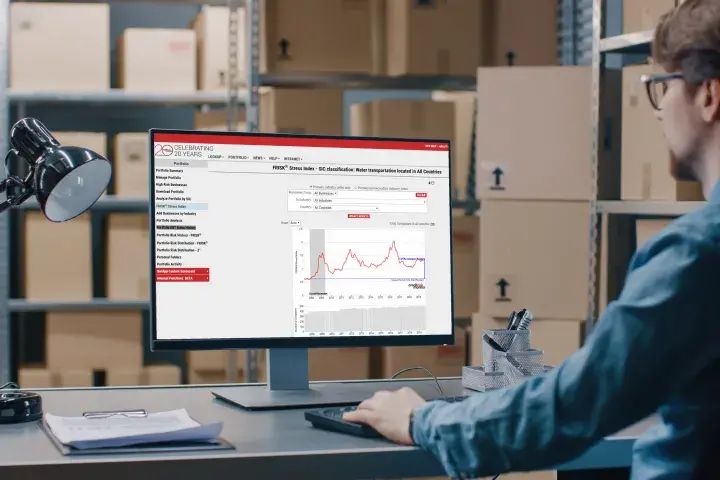

Sanctions have delivered significant financial stress to the Russian government and corporations alike. Overall, many Russian companies have dropped into – or have sunk further down into – the FRISK® score red zone, indicating heightened financial stress and corporate failure risk.

Resources

Stay ahead of public company risk with our bankruptcy case studies, high risk reports, blogs and more.

In 2019, nearly half of the 230 publicly traded Chinese construction companies we cover are financially distressed. If you have exposure to China’s real estate market, we urge you to monitor closely the financial risk potential of your commercial counterparties.

Public company financial risk is higher than it has ever been, and the weakest links in your supply chain may lead to costly, time-consuming problems.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how bond agency ratings play a role.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. The first of a five-part look at these inputs, here’s how the stock market plays a role.

With concerns surrounding China’s economy and the sharp decline in the Baltic Dry Index, risk professionals should be vigilant in monitoring the changing conditions in the shipping industry.

The Federal Reserve recently voiced concerns about excessive corporate financial leverage - and risk management departments need to take heed.

The FRISK® score is a game-changing tool that combines several key inputs to assess bankruptcy risk. Here’s how credit manager crowdsourcing play a role.

Business at casinos and resorts has picked up following an easing of travel restrictions after COVID-19, yet operators worldwide continue to be tested by steep fixed cost structures and debt-loaded balance sheets.