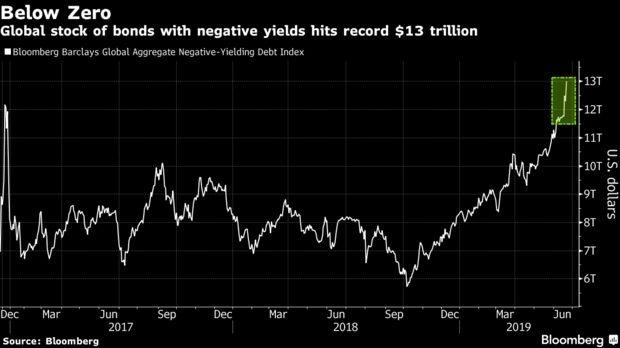

Negative yielding debt worldwide reached a record high of $13 trillion, according to Bloomberg in June 2019.

The Fed and ECB have started open discussions with the Bank of Japan to learn about implementing BOJ’s unconventional “Yield Curve Control” program. Under this monetary policy, a central bank attempts to control the entire yield curve by targeting specific long-term interest rates through the purchasing of large volumes of securities at various maturities, thereby artificially lowering yields.

However, central banks realistically have less control than market forces and one massive unintended consequence of previous asset purchasing activity has been in the high yield credit market. For example, a portion of the European high yield (junk) bond market is now yielding negative interest rates. Not only is this development extremely worrisome given that it signals deterioration in the underlying trend of global economic growth, but downright oxymoronic. During economic downturns, debt servicing becomes severely constrained and corporate bankruptcies surge. So are you prepared for the next tidal wave?

Escalating Financial Stress

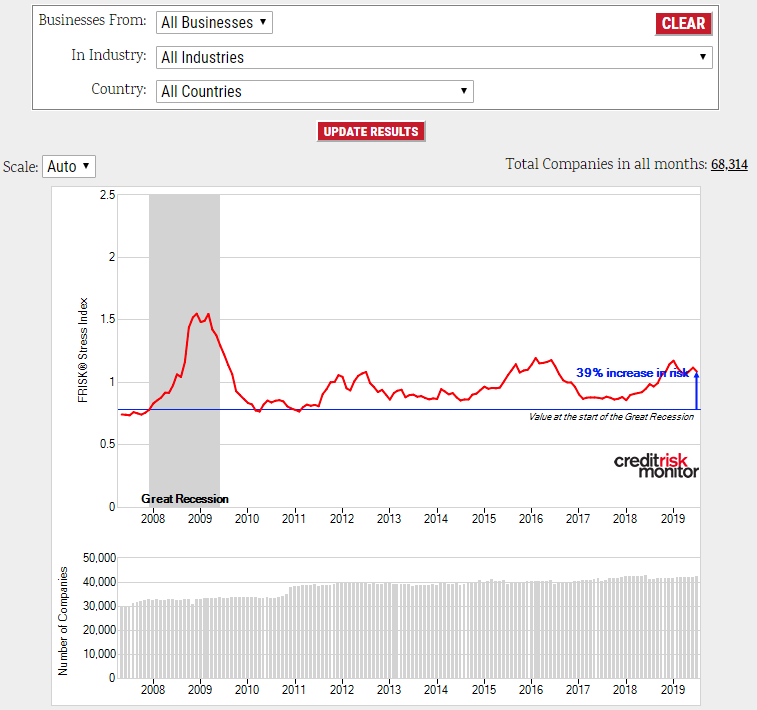

CreditRiskMonitor’s FRISK® Stress Index measures the “probability of failure” over the coming 12 months across any collection of public companies within any industry, geography or customized portfolio – and it confirms the trend toward peak risk levels. For example, the FRISK® Stress Index below is measuring elevated financial risk across the aggregate of public companies globally:

Within this risk index, CreditRiskMonitor has identified three important trends:

- 16% of public companies globally have higher than average risk of bankruptcy

- Nearly 500 businesses are among the worst risk category of “1” (bankruptcy risk up to 50% in the next 12 months).

- Oil & gas is the most distressed, where risk is 2.5 times that of the average industry.

These statistics will only worsen when broader economic conditions deteriorate and companies will have to work through widespread counterparty risk. Therefore, make sure you can identify your company’s own risk exposure to mitigate disruption and financial loss.

Bottom Line

The global economy appears to have deteriorated in a significant way during 2019 given the trends in negative yielding debt. Institutional investors significantly expanding their negative yield exposure expresses a view that the global economy is facing deflationary forces and a recession is on the horizon. Our FRISK® Stress Index also signals rising financial distress in public companies. To prepare your company before the next crisis unfolds please contact us for a free risk assessment.