Major drug manufacturers Mallinckrodt plc and Endo International plc are financially distressed due to elevated debt and product-related risks. If your company is doing business with these manufacturers, you should evaluate your risk exposure and perform further research.

In 2019, both CreditRiskMonitor’s FRISK® score and PAYCE® score each correctly identified the bankruptcy risk for the pharmaceutical operators Purdue Pharma L.P. and Insys Therapeutics. Mostly due to mounting opioid litigation, Purdue Pharma ended up filing for bankruptcy in September and Insys Therapeutics filed back in June.

Using the FRISK® Score

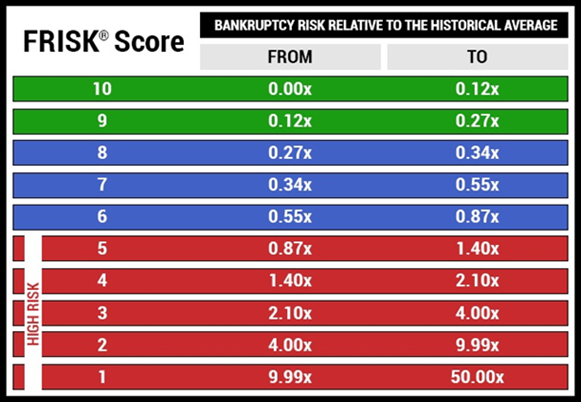

Through the combination of financial statement ratios, stock market data, bond agency ratings and subscriber crowdsourcing, the FRISK® score provides risk professionals a 96% accurate assessment of public company financial risk.

What elevates the CreditRiskMonitor service is the blend of these factors, reaching a higher plane of analytical understanding. It’s one thing to have the data at hand, but another in harnessing each of these metrics and synthesizing those findings into an easy-to-understand format. The methodology of our proprietary FRISK® score is what makes the overall result an invaluable solution for professionals.

When the FRISK® score trends into the “red zone,” subscribers need to be mindful of the company’s risk profile. Subscribers will receive an alert as the FRISK® score trends lower, which provides the opportunity to address risk before a worst case scenario transpires. See the FRISK® scale below:

A Brief Review

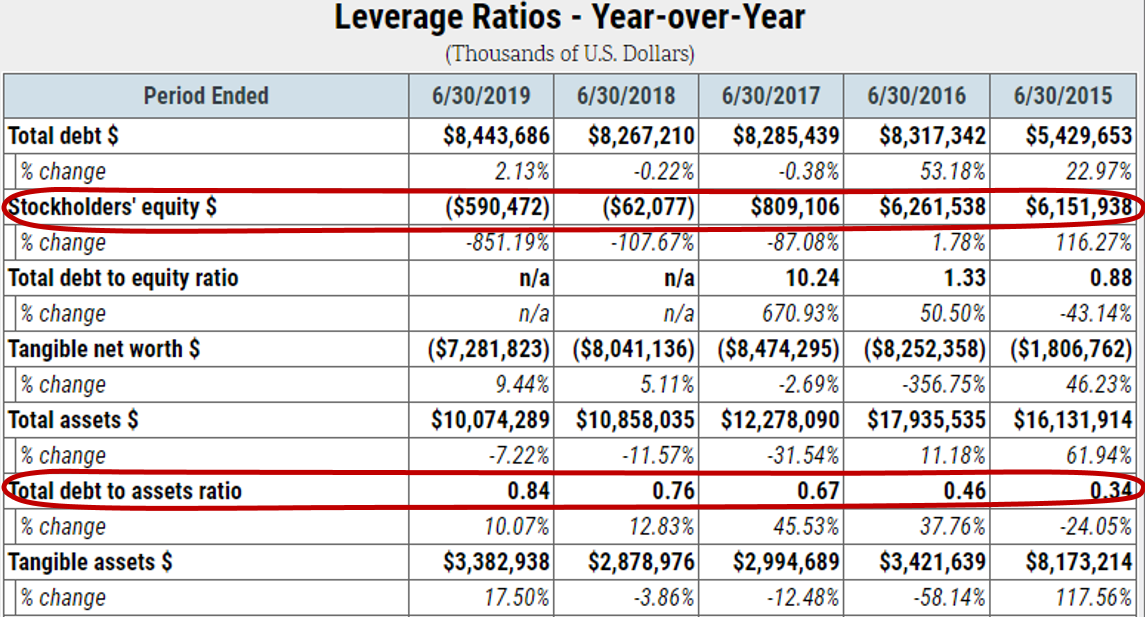

Endo International plc’s FRISK® score has declined to a “2,” one of the higher risk categories. When reviewing the company’s second quarter year-over-year interim leverage ratios, shareholders’ equity has steadily trended from positive to negative territory. Alternatively, debt-to-assets has deteriorated to the bottom quartile of industry peers:

Impairment charges on its product portfolio drove most of the deterioration in its leverage metrics.

However, management amended its revolving credit facility to loosen its covenant leverage ratio from 3.5x to 4.5x, among other things, which provided additional financial flexibility. Another bright spot is that management has proactively accumulated $1.76 billion in cash and cash equivalents, which should offset near-term settlements and preserve its overall liquidity.

Mallinckrodt plc’s FRISK® score has fallen to a “2.”

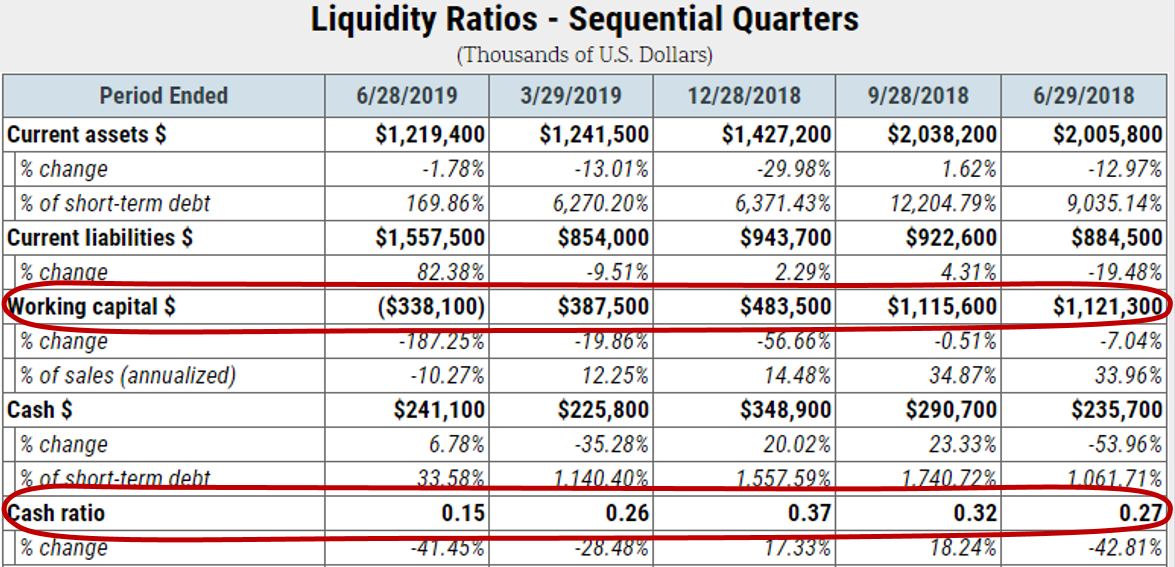

In the second quarter MD&A, released in August, management stated that the company will have sufficient liquidity for the foreseeable future. Although, the company is still faced with its April 2020 debt maturity and refinancing risk appears elevated.

Without plugging that funding hole, cash is low relative to current obligations. When combining its cash and cash equivalents plus accounts receivables against its current obligations (excluding the April 2020 debt maturity), its liquidity profile appears weak. See Mallinckrodt’s ratios below:

Bloomberg also published a report in September stating that Mallinckrodt hired restructuring advisors and could file for bankruptcy.

Bottom Line

Unsecured creditors should be mindful of bankruptcy risk trends in the pharmaceutical industry. The FRISK® score is showing that Endo International and Mallinckrodt have vulnerabilities. As the FRISK® score is updated daily, subscribers always know which of their counterparties they should monitor the most carefully. The best attributes of the FRISK® score are high accuracy and prompt timing – and it is why more than 35% of the Fortune 1000 rely upon it to help make critical credit decisions. For a comprehensive assessment of all healthcare industry operators, contact us today.