Despite widespread tariffs, China's size and rapid ascent up the socioeconomic ladder is an alluring market to open new accounts. Similarly, India is a prime place to do business due to its low operating costs and healthy economic growth. CreditRiskMonitor, a leading web-based financial risk analysis and news service designed for credit, supply chain and financial professionals, provides financial and risk coverage in both China and India so that risk professionals indeed have that sometimes-elusive understanding of each market before diving in. CreditRiskMonitor subscribers – a group which includes credit managers from more than 35% of the Fortune 1000, have access to a whopping 11,000-plus public company credit reports from these two nations alone.

Vague regulations and secrecy make it difficult to properly gauge risk levels in China. In India, low operating costs and a swath of companies in highly desirable industries – like tech – look appealing, yet growth opportunities in India often attract an influx of new companies that might not be able to pull their weight. As a result, credit managers must be cautious in dealings with each nation.

When something stinks with public companies, we have developed the solutions to spotlight it immediately. The fertilizer market in both China and India are excellent industry-specific examples of the possible issues financial professionals could face.

What the FRISK®️ score Says

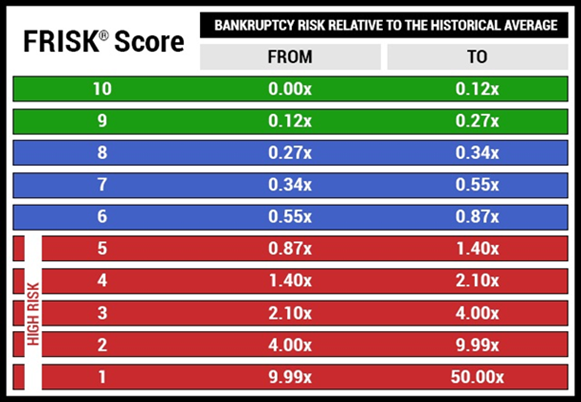

The CreditRiskMonitor FRISK®️ score is a risk professional’s ultimate defense against potential loss, as it pinpoints when you need to start paying attention to rising public company bankruptcy risk. Factoring in stock volatility, bond agency ratings, financial ratios and crowdsourced subscriber behavioral data together, a simple metric is born, indicating the bankruptcy risk level of a public company with incredible accuracy. Judging public companies on a 1-to-10 scale – “1” being the worst and “10” being the best – we are 96% accurate* in predicting public company bankruptcies within a 12-month window.

Of the 4,192 India-based public companies in the CreditRiskMonitor database, around 30% are in the FRISK®️ score “red zone,” meaning having a score of “5” or lower. In China, out of the 7,126 companies monitored within the CreditRiskMonitor database, about 20% of the companies are in the red zone. After the crunch: there are more than 1,000 public companies in China and India which we feel are at heightened risk for bankruptcy between now and next October.

Digging into the Fertilizer Industry

Material population growth is usually a sign of strength and can bolster economic expansion. One market segment that would normally see positive results from a growing population is the fertilizer industry. But fertilizer commodity prices remain weak, and some of the companies within the industry have heavy debt burdens. Below is a selection of fertilizer companies in both countries that are within the FRISK®️ red zone, exposing counterparties to elevated bankruptcy risk:

| Company | Country | FRISK®️ score |

| Hubei Yihua Chemical Industry Co., Ltd. | China | 1 |

| Sichuan Lutianhua Company Limited | China | 2 |

| Yunnan Yuntianhua Co., Ltd. | China | 2 |

| Yangmei Chemical Co Ltd. | China | 2 |

| Zuari Agro Chemicals Ltd. | India | 2 |

| Madras Fertilizers Ltd. | India | 2 |

| Nagarjuna Fertilizers and Chemicals Ltd. | India | 3 |

| National Fertilizers Limited | India | 3 |

| Liuzhou Chemical Industry Co., Ltd. | China | 3 |

| Mangalore Chemicals & Fertilizers Ltd. | India | 3 |

We’ll take a look into the financials of two companies listed above to examine some of the reasons for their low FRISK®️ scores.

Zuari Agro Chemicals Ltd

This Indian fertilizer manufacturer and seller has been in the FRISK®️ red zone for the last 12 months, but for a while, it was able to sustain a score of “5,” which is right at the top end of the red zone. However, since May, Zuari Argo Chemicals has seen a steady deterioration in its FRISK®️ score, which now sits at “2,” highlighting an exponential increase in risk.

Leverage is a huge problem for this particular company. As of their last annual reporting on Mar. 31, 2018, the company’s total debt was ₹45 billion while tangible net worth only amounted to ₹13.5 billion. The company's total debt to assets ratio of 0.54 sits in the bottom quartile of its industry peers. Also alarming is that nearly ₹40 billion of the total debt load is classified as short-term debt. Having lost money in three of the last five fiscal years, Zuari Argo Chemicals could find itself facing financial demands it can't meet.

Sichuan Lutianhua Company Limited

Also a fertilizer manufacturer and seller, Sichuan Lutianhua Company Limited is located in China and has been in the FRISK®️ red zone for over a year. Unlike India’s Zuari Argo Chemicals, Sichuan Lutianhua has been at a “2” for nearly a year. Leverage is an issue here as well.

As of the company’s most recent quarterly reporting on June 30, 2018, the company’s total debt load was at ¥4.8 billion. That's down from over ¥9.2 billion in period ended Dec. 30, 2013. However, the company's total debt to assets ratio is a troubling 78%. Tangible net worth, meanwhile, is negative ¥895 million. Tangible net worth, though some improvement has been made in recent months, first dipped into negative territory in 2016. Complicating matters, short-term debt accounts for just under 50% of the company's total debt load.

Bottom Line

Even in economies that may appear healthy, based on China and India’s strong growth, risk is present. This is an example of why risk professionals need to perform careful research before entering either of these markets. Constant monitoring is equally important. The FRISK®️ score, with its global reach, provides an important and necessary starting place, which can help risk professionals focus their attention on their biggest risks and mitigate loss before it hits the bottom line.

*As backtested on U.S. public companies; results may vary for private companies and by country. All references to the FRISK® score’s accuracy on the CreditRiskMonitor website are qualified by this statement.