Nation’s Restaurant News reported in September that U.S. chains have shown persistent declines in foot traffic, and this past July and August demonstrated the worst YTD performance of negative 4% year-over-year. If traffic declines persist, then highly indebted restaurant chains could be at risk of bankruptcy.

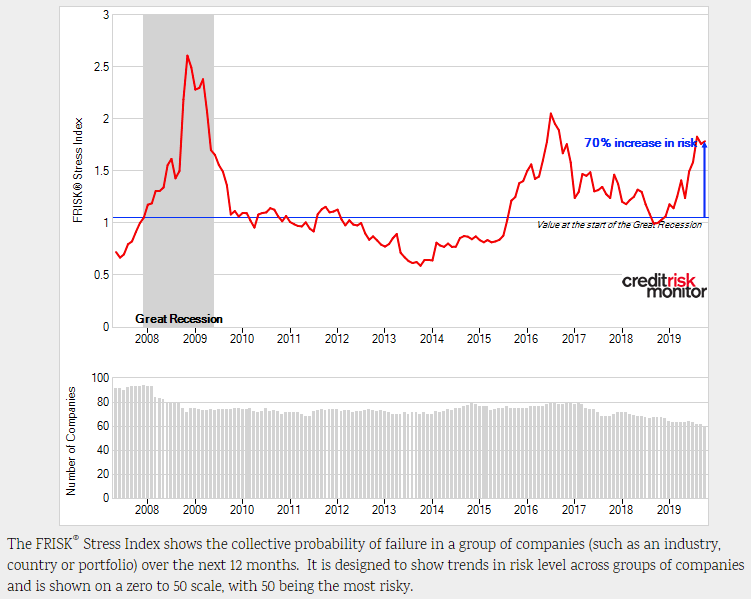

CreditRiskMonitor’s FRISK® Stress Index on U.S. restaurants (SIC 58) has demonstrated an acceleration over the last three quarters. In October, aggregate financial stress across restaurants reached 1.8x, indicating nearly twice as much risk versus the typical industry. During 2016, a handful of restaurant chains filed for bankruptcy and we’ve reached similar risk levels once again:

Looking at the FRISK® Stress Index as a barometer, CreditRiskMonitor identifies more than 30 restaurant chains that are financially distressed, some of which have elevated risk of bankruptcy over the next 12 months. If your company is doing business with a restaurant, review your company’s exposure and analyze the counterparty’s financial condition.

Looking Forward

Creditors should be mindful of broader economic risk. Restaurants margins have been under pressure and those that have a fragile capital structure will have a red zone FRISK® score and ultimately could trend into bankruptcy. The 96% accurate FRISK® score identifies bankruptcy by using a “1” (most risky)-to-“10” (least risky) scale. Four companies with their FRISK® scores as of Oct. 14, 2019, are shown below, which demonstrates the risk of bankruptcy versus the average 12-month industry bankruptcy risk of 1%:

| Company | FRISK® score | Bankruptcy Risk Versus Average Industry |

| Diversified Restaurant Holdings, Inc. | 2 | 4x-10x |

| Granite City Food & Brewery Ltd | 2 | 4x-10x |

| Fiesta Restaurant Group Inc. | 2 | 4x-10x |

| Red Robin Gourmet Burgers, Inc. | 3 | 2x-4x |

Considering second fiscal quarter data, these four restaurant chains appear financially distressed:

- Diversified Restaurant Holdings, Inc. presently operates more than 60 Buffalo Wild Wings locations. In the second fiscal quarter, the company disclosed it is in negotiations with its creditors. Due to this contingent risk, company management has informed that there is substantial doubt about the company’s ability to continue as a going concern.

- Granite City Food & Brewery Ltd runs more than 40 casual-dining restaurants across the U.S., but it could soon file for bankruptcy. The chain is losing sales revenue at a low-to-mid single-digit rate and generating negative free cash flow against a weak liquidity profile.

- Fiesta Restaurant Group Inc. runs more than 300 fast-casual restaurants. The business has a healthy trailing 12-month interest coverage ratio of 6x. Although, persistent traffic decline could cause operating deleveraging and reduce coverage levels. Financial debt was about 4x cash and short-term investments and accounts receivables.

- Red Robin Gourmet Burgers, Inc. operates nearly 500 corporate-owned restaurants and has about 90 franchise restaurants. On a year-over-year basis, the company’s second quarter trailing 12-month interest coverage ratio deteriorated from 4x to 2x. Financial debt exceeded total cash and short-term investments and accounts receivables by nearly 5x.

In an economic downturn, creditors (including landlords and vendors) may face an increasing number of restaurant defaults and bankruptcies. Use the FRISK® score so your company isn’t blindsided.

Bottom Line

Dining-out traffic trends are showing persistent weakness and economic recession risk continues to accelerate. If you are working with a restaurant chain that has a weak capital structure, you should implement strategies to reduce risk or otherwise face the possibility of serious financial loss. The four aforementioned operators represent only a fraction of all distressed restaurants in the industry. To stay ahead of public company financial risk in this industry, contact us today at 845.230.3000 or click here.